Here in the personal finance world, many of us dispense information about saving money, living frugally, cutting back on expenses…anything to help you manage your money in the best way possible. I know I do it, and some of my favorite blogs do it. It’s information that most people need but unfortunately, a lot of the tips given are ludicrous. They may amount to small savings, which is good and I’m sure that lots of people need those small savings (after all, little things do add up), but when you think about the tips from a practical standpoint, they’re not always the best route.

Here in the personal finance world, many of us dispense information about saving money, living frugally, cutting back on expenses…anything to help you manage your money in the best way possible. I know I do it, and some of my favorite blogs do it. It’s information that most people need but unfortunately, a lot of the tips given are ludicrous. They may amount to small savings, which is good and I’m sure that lots of people need those small savings (after all, little things do add up), but when you think about the tips from a practical standpoint, they’re not always the best route.

A few of the ones that I can’t stand:

- Unplug appliances and electronics when not in use. Fine, vampire electricity is a real thing. But going around my house every single time I want to leave or every single time I come home is a nuisance. Do you know how difficult it is to get to some of the power cords? Also, I hate resetting clocks. Almost every appliance in my house is attached to a clock. Instead of unplugging everything. I’d rather just turn things off. For instance, we sleep with a fan even in the dead of winter. When we’re not asleep or in the room, we turn the fan off. Simple. Fan’s not running, we’re not paying for it. But as for the power strip that holds the cord for our TV, the Wii and the Blu-Ray player, I’m not turning it off every time I leave the house. It’s impossible to remember so I’m not even going to try. I’ll pay the extra $.74/month (or whatever it costs).

- In the event of a job loss, cut back on everything. Sell your house. Live like a pioneer! I concur that when times are tough, it’s important to think more discriminately about your finances. If you have expenses that can go, then let them go. But to suggest that you take a weed whacker to everything is irresponsible advice. People have contracts that it costs money to get out of. People need the internet for job hunting or job creation and may not have access to free sources of internet (check rural areas. It happens). Public transportation may not exist and a car is necessary to get around. As for pulling a kid out of daycare entirely, really think about this before you do it. Kids need routine and to upend them entirely from that is not fair. I suggest negotiating with your daycare provider or moving the kid to part-time, if possible.

- To save money on groceries, cook everything from scratch. Yes, cooking from scratch is healthier and in many instances, cheaper. But not all the time. Like the time I tried to make my own bread. Besides the gastric distress I found myself in as a result, it cost a fortune to buy the ingredients (approximately $20). And, if I wanted to buy a bread machine, that’s another $100 or so right there. I understand that in the long run, it might save a ton of money but we don’t eat enough bread to reap the benefits. So I went back to spending my $2.50 on a loaf of bread. It’s less expensive and my stomach is much happier. If you’re going to cook everything from scratch, more power to you. But I don’t believe that the “it’s cheaper” is an absolute.

- Coupons are the best way to save money ever!!! No, they’re not. Coupons are not the end all and be all of saving money. They are cumbersome to clip and keep track of us, especially expiration dates, they are often not available on the items that I use and I can typically find a better deal on generics. Plus, the fine print is exhausting. There are times that coupons come in extremely handy, especially if one store that you frequent accepts coupons from other stores. My grocery store often gives out $10 off your next purchase coupons and I like these (as long as I remember to bring the coupon and it’s not expired). But to say that coupons are, exclusively, the only way to save money is just bad advice.

- If you need extra money in a hurry, have a yard sale. Oh, I think I hate this one the most. I have never had a yard sale nor do I plan to ever have one. For starters, not everyone has enough stuff to sell that would make a yard sale even remotely profitable (I know I don’t). Then there’s logistics…getting permission from the HOA, finding a good time to have it, making contingency plans in the event of bad weather, advertising. Not to mention pricing the items and having to worry about haggling with customers. It’s just not worth it to me (and probably numerous others). Because by the time the yard sale would be ready to go, the need for the money would have passed. I do suppose it’s a better suggestion than using a payday loan company, though.

Some other money saving measures that are foolish and make no sense (as provided by readers and friends):

- Make your own laundry detergent. Who has time for this? Is it even worth the effort?

- Save $x (insert small number) per day. Right, because everyone has even that small amount just lying around.

- Brown bagging lunch or cutting out lattes. What if you already bring your lunch and don’t drink coffee?

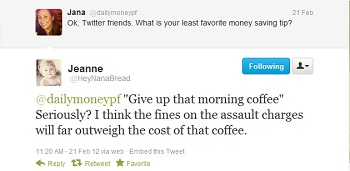

- And my favorite:

What is your least favorite money saving tip?

In addition to the laundry detergent making abilities one must somehow have, you must also not use your clothes dryer and line dry all your clothes. Not using the dryer saves you money, right? Ummmm…this is sooooo not practical! 🙂

Mackenzie recently posted…Weeds and Wildflowers

I actually do hang up some of my clothes but that’s more for preserving the clothes than saving money. And, from my understanding, if you have a good washer, the dryer shouldn’t expend that much energy anyway. Line drying is so much more work! And what do you do in the winter?

Lease favorite saving tip… rewashing ziploc bags. It just drives me nuts. I’d rather spend some more and get a nice glass container to take my sandwiches.

Well Heeled Blog recently posted…Financially Ready To Have Kids?

Totally agree with this one!

These are great! The energy spent doing any of the ones you mentioned is just not worth it. The amount you’ll save by a simple phone call to save on your car insurance will more than pay for all the savings in everything you mentioned..combined..and with much less effort.

I Am 1 Percent recently posted…6 Ways To Be Obsessed with Finances

I totally agree! I’d much rather negotiate a lower rate on my cable bill than unplug the TV every time I leave the house. Much easier and a whole lot less effort.

Haha. I like it. We’ve never been “penny smart” people. I generally shut off lights and stuff like that, but haven’t done the unplug/plug thing. I’ve thought about it – maybe I’d see how much money it actually saves. But I try and focus on bigger fish. I get good coffee at work, so no anger management necessary on my end, for free too!

Plus, all the time I’d spend unplugging things is time I could spend pissing people off online by talking trash about sleep away camp, which is a lot more fun…

Nick recently posted…How rude are you?

We’re not penny smart people, either. I save plenty of money on coffee, too. I don’t drink it. Ever.

And I certainly wouldn’t want to suggest you do anything that would detract from talking trash about sleep away camp!

Milling your own lumber. That’s got to be a stupid one.

101 Centavos recently posted…Take It Easy, Just Go For a Walk

People actually suggest this?! I have never, ever heard of this. But yes, if you’re not living in 1847, it’s pretty stupid.

What I hate most is when people question why I have pets or set aside as much money as I do for their care. Because obviously, saving money should be the most important part of my life instead of enjoyment of my life.

Can I suggest parents get rid of their kids or at least start skipping their pediatric appoinments and don’t buy them glasses. Because that would save money.

Oh, the “get rid of your pets” suggestion makes me so angry just as it infuriates me that when someone is in debt and struggling with monthly expenses, one of the standard suggestions is to get rid of her pets. They are living beings, not disposable items.

This one makes me furious too! I love my cat, she has been living with me for 10 years, I could never get rid of her!! She is not a disposable thing! I saw once someone commented to another PF blogger that she should get rid of her cat after she posted about the cost of having a pet…

Ella recently posted…Microsaving

Ugh, yes, this one is awful too! I had to find a new home for my cat because my son developed allergies, and it was the worst! (Even though I know he is loved, spoiled, and happy).

Kris @ BalancingMoneyandLife recently posted…Friday Link Love – What I Read This Week

I actually did the plug/unplug thing when I was single. It helped that a TV and a microwave was all I had. I’m not sure how much electricity that actually saved but I did have very low power bills.

Andy Hough recently posted…Thank You Yakezie Giveaway

Wait Jana here’s one – make your own bottled water! I actually read a guy, or girl maybe, who boiled tap water, then cooled it overnight, then poured it into plastic bottles. Really? Just buy a damn water filter already if you can’t stand the water.

If I don’t drink coffee, I won’t be productive enough to make any money.

That just isn’t going to work for me 🙂

jefferson recently posted…The Great Mortgage Money Shuffle

The giving up coffee thing is too much. While we are at it, lets stop drinking water, using water to bathe etc. so that we can save on the water bill too.

Tushar@EverythingFinance recently posted…Know Your Taxes – Excise Tax

Unplugging appliances is definitely not practical for us, and as silly as this sounds we actually keep the kitchen light on for the dog when we leave (yeah we’re those kind of people). I just wrote a post about how we started saving a lot of money packing lunch (but like you said if you already pack your lunch then you’re not going to save any more money there).

Kari recently posted…Save $4800 a Year Packing Your Lunch

I wrote a very similar post last week (in my link)! I also included the vampire power thing on my list. But we already bring our lunches to work every day and neither of us likes coffee – major money savers! Different suggestions work for different families.

Emily @ evolvingPF recently posted…Living a Step Behind

Love this post! I’m allergic to coffee, eat lunch out maybe once a month, if that, cook at home all the time (because I’m good at it, I like it, and I’m fussy about what we eat!), am willing to pay for my vampire electricity… I hate the “latte factor” type of advice!

The other thing I hate are blogs or columns that advise you to “just transfer $300 ($400, $500) extra a month away to save for that next (car, appliance, home repair). If I had $300 extra a month, don’t you think I’d be out of debt faster??? DUH!!!

Thanks for the laugh, I needed it!

Kris @ BalancingMoneyandLife recently posted…Friday Link Love – What I Read This Week

Every time I see the suggestion about unplugging unused electronics I wonder if anyone REALLY does that. While I’m really good at shutting things off when they aren’t in use I cannot imagine unplugging everything after I’m done with it. I’ve never been a fan of coupons, I’m too lazy to start an elaborate coupon binder to keep track of them and so many coupons I see are just for items I won’t use.

Addie recently posted…Look at all those zeros!!!

I’m too lazy for coupons, too. I’ve learned to become OK with that!