Sharing my favorite posts

For today’s post, I wanted to list some of my favorite blogs of the year. So I thought and though and read and read and then realized that there was no way in hell I could pick my favorites. Every blog I read offers something else. Whether it’s information, humor, entertainment, thought-provoking opinions, skills, or inspiration, I truly enjoy every blog I read (well, all but 1. There’s one I read that I can’t stand but I feel compelled to read it). Picking my favorite blogs is akin to picking a favorite pet or child–you know you have one, you just don’t want to admit it for fear of insulting the other ones.

Instead, I’m going to pick some of my favorite posts from this very blog. In no particular order, here are some of my favorites:

The Tale of the $100 Paycheck–the story of my very first real paycheck.

Going on a Snowflake Hunt–little ways I’ve found to add money to my debt repayment

What I Learned from Controlling My Spending–the lessons I’ve learned from years of participating in a control/no-spend challenge

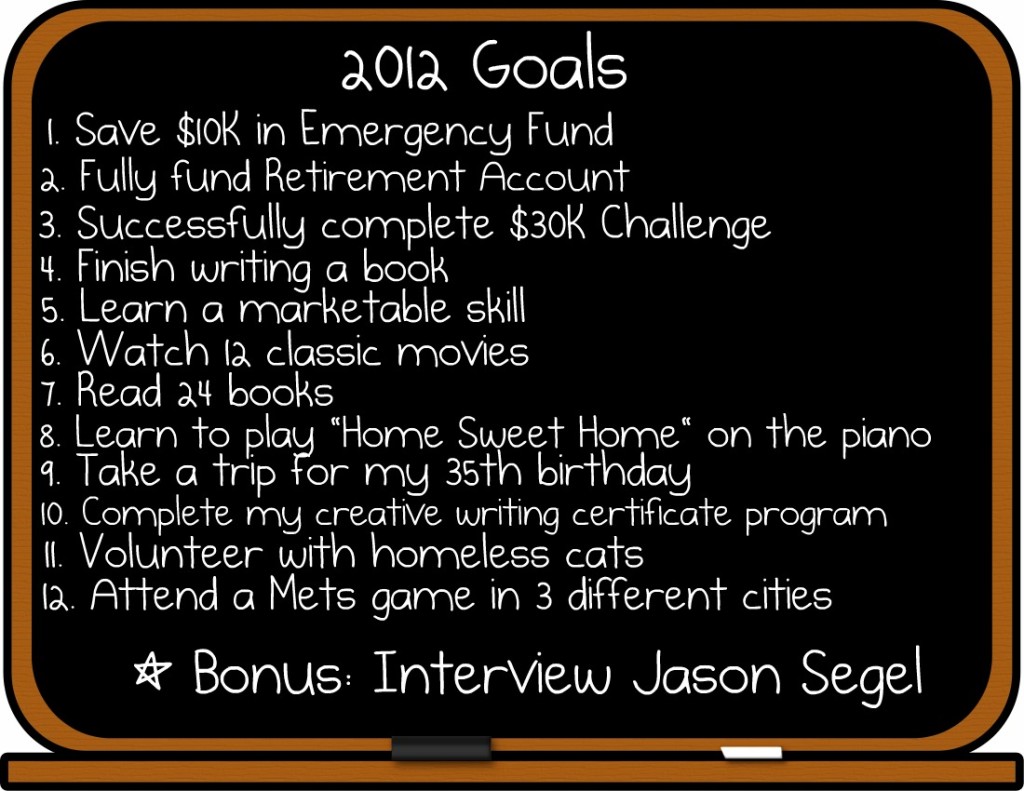

Fear Factor: Self-Employment–I outline my fears for taking the plunge into self-employment. Admin note: I’m pretty much over my fear and I’ll hopefully be jumping into self-employment in the next 6 months. Also, there’s Jason Segel reference. I really need to get started on my interviewing project.

Dependent Care: How We Do It–an explanation of how we maximize our DCA

What Downward Dog Taught Me About Finances–I took a yoga class and it made me think about money. And farting.

To all my readers, thanks for such a wonderful year! I’m proud of what this blog has become and it is entirely because of you. Thank you for coming back and reading and commenting. I appreciate every single one of you more than I can say. I’m looking forward to 2012!!!

What makes a personal finance expert?

Someone recently asked this of me: “You write about personal finance. What makes YOU an expert?” Let’s forget about how ridiculously rude that question is and focus on the answer.

The quick answer: Nothing. There is nothing that legitimately qualifies me as a personal finance expert. I don’t have a degree in business, finance, accounting or anything of that nature. I’ve never been a business owner. I don’t have any certificates, licenses or fancy letters after my name. I’ve never run a company. Hell, I’ve never even been a supervisor. So really, nothing formally qualifies me as an expert.

I continued in my rambling by saying that I rarely give how-tos and I even more rarely dispense information on topics such as IRAs, life insurance, mortgages, etc. I leave that to other bloggers who are legitimately qualified to discuss them. I am not an authority or an expert on those topics and I don’t pretend to be. I even mentioned that I have a disclaimer telling my readers that I’m not an expert and that the information shared is based solely on my experience, opinions and mistakes. This person seemed satisfied with the answer and moved on.

But here’s the problem: I don’t really believe that answer. I do think I’m an expert. I’m not an expert in the global sense or in the manner of Dave Ramsey or Suze Orman, and I’m certainly not qualified to dispense professional advice. But I am an expert on me and my finances. I’m an expert on my life. I know what I did, what I didn’t do and what I should have done. I’m an expert on my stories, experiences and opinions. I’m an expert on what I’ve learned works and doesn’t work for me. I’m an expert on what I wish I had learned. I learned enough to be able to articulately and authoritatively discuss personal finance as it relates to me.

The core of this whole discussion, for me, is the term “personal finance”. The word personal is what I’m choosing to focus on. Yes, there are basic concepts of general finance. But personal means that each person can take those concepts and apply them as needed to her own situation. That is what I claim to be an expert in–my personal finance and how my experiences with my finances have affected my perspective.

And that’s what makes me an expert. While I knew about credit, budgeting, saving, investing, insurance and all of the other components of personal finance in it’s abstract concepts, I didn’t really get my education until I had to. If I wanted to eat and pay my bills, I didn’t have a choice but to learn. I took it upon myself to learn how to budget and get out of debt. I read and talked to people and then read some more. I took that information and applied it to my situation. By getting into and out of debt, I’ve learned more about the practical application of personal finance than I would have had I had a degree or license or certificate.

Let me be clear. This is not to say that I believe that a basic, school based education is not important. I think that all kids should be taught the basics of personal finance, especially since so many kids do not get that education at home. I didn’t. But I learned about it in school. That basic education made it possible for me to write checks, manage a bank account and pay bills when I was in college. But I didn’t get the real, hardcore education I needed until I found myself deep in debt. That’s when I started reading, learning and practicing the fundamental concepts of personal finance. That’s when I learned how to take those abstract concepts, make them concrete, and use them in my life.

I hope that as I tell my stories and share my perspective, people can learn from them. I hope that some of my stories are a cautionary tale, some are inspirational and some are just entertaining. What’s important to remember is that those experiences made me a smarter, more knowledgeable person who is now equipped to share that firsthand knowledge with others. My hope is that others can learn from my experiences. If one person can get on her own path towards being debt free or if I prevent one person from going down the same road I traveled, then I did a good thing.

So the next time someone asks me what qualifies me to be an expert, I have my answer. That answer? Life. Life made me an expert.

How would you have responded to that question?

Reader Question: Am I doing the right things to get out of debt and save for a family?

One of my favorite parts of blogging is my readers. I’m so appreciative and grateful for all of your comments and engagement on Daily Money Shot. It’s what keeps me wanting to do better. I especially enjoy hearing from my readers via email.

Last week, one of my readers, Krista, contacted me asking for help. She desperately wants to pay off debt and start having kids. I encourage both of these! However, in her email, she stated that she was unsure if she was doing the right things to get on track to pay off her debt by the time she’s 30 and to start planning for a family. After analyzing her situation based on the information she provided, my unprofessional opinion is that she is doing the right things. With a little tweaking, I think both of her dreams can come true.

The facts

Krista brings many positives to the table. First, she’s young–she’s only 25. This means that by getting things under control now, she’ll have a long, happy debt free future. Second, she has the motivation to get out of debt. Motivation is essential. Without motivation, her goals will fall flat. Third, she is already aware of her debt. I firmly believe that the first action step towards paying off debt is to know exactly how much debt you have. She’s already added it up! She knows what she’s in for. Fourth, and most importantly, she has goals–to be debt free, to have children, to save money. Establishing goals is key. You need to know what you’re working towards. Haphazardly paying off debt or saving without a purpose gives you the latitude to be lazy.

Money Tune Tuesday: Joy and Pain

I think I’ve mentioned once or twice that I’m originally from Long Island. Growing up in an upper middle class suburb has definitely impacted my views on personal finance, excess, and the craziness that happens when those two come together. For instance, bar and bat mitzvahs.

Long Island is infamous for its outrageous bar and bat mitzvahs. Not only is it a huge rite of passage for a Jewish boy or girl, it’s almost an introduction of sorts into the Long Island scene of ridiculous and outrageously expensive parties. Even 20+ years ago, when I was that age, the parties were the perfect description of extravagence and excess. More food than you can imagine, and separate food (and tables) for the kids and adults. Fancy, professionally calligraphied invitations, open bars, DJs, dancers, expensive favors, dessert tables, photo booths and centerpieces…Long Island bar and bat mitzvahs can put many weddings to shame. A bar or bat mitzvah on Long Island can easily cost $20-$30,000. Sickening.

While the price tag makes me grateful that I don’t live on Long Island anymore, I still smile when I think about my bar and bat mitzvah going days (including the god-awful dresses I wore with my super fabulous 1990 hair). They were seriously good times. And the music. Oh, the music. I still can’t hear “Crocodile Rock”, “Oh, L’Amour” or “Celebration” without a big goofy grin covering my face. But my favorite memory of bar and bat mitavahs (besides memory glasses, of course) is hearing Rob Base and DJ EZ Rock.

So, for today’s Money Tune I bring you “Joy and Pain”. Not as well known as “It Takes Two” but just as awesome. Totally!

- « Previous Page

- 1

- …

- 194

- 195

- 196

- 197

- 198

- …

- 221

- Next Page »