I’ve been cranky about a few things lately. I’ve decided that I’m going to share those things with you because you might be cranky about them, too. If not, please just bear with me. If you’re not in the mood for crankiness, that’s totally fine, too. I understand.

There is something that occurs with some regularity in the personal finance blogosphere that irks me to a fairly large degree. I’ve been struggling with how to phrase it properly but then I gave up on that so I’ll just sum it up this way:

It’s the “all or nothing” attitude that many bloggers convey.

It bothers me that many bloggers take the position that finance lives in absolutes. It does not. Finance is all about grays; it’s not black and white. What may work for one blogger may not work or cannot work for another. For instance, my family will never be a 1 car family. That works for us. But for many bloggers, they would assert that in order to be frugal or smart with money, a family must only have one car and having two cars is a sign of overspending, a waste of money, and the first step down a narrow, dirty hallway of financial irresponsibility. It’s as if they forget that there are different places in the world, complete with different circumstances and logistics. That’s not really helpful.

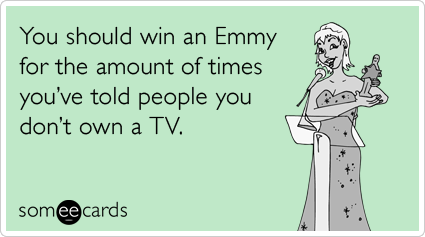

Neither is asserting to the world that you do not watch any television at all and are therefore more well read, more well rounded and more productive. Speaking from experience, it is possible to be a bookworm, a productive, engaged, inquisitive individual and still indulge in a crappy reality show or serial drama every now and then. Watching TV does not spell the demise of a person’s intelligence or productivity; it just means that that person likes to turn her brain off every now and then and just relax. And there is absolutely nothing wrong with that. TV shows in moderation do not ruin a person, but I will concede the point that too much programming might interfere with other pursuits. Depending on the person.

Neither is asserting to the world that you do not watch any television at all and are therefore more well read, more well rounded and more productive. Speaking from experience, it is possible to be a bookworm, a productive, engaged, inquisitive individual and still indulge in a crappy reality show or serial drama every now and then. Watching TV does not spell the demise of a person’s intelligence or productivity; it just means that that person likes to turn her brain off every now and then and just relax. And there is absolutely nothing wrong with that. TV shows in moderation do not ruin a person, but I will concede the point that too much programming might interfere with other pursuits. Depending on the person.

Then there’s the whole issue of coupons. I can’t stand this debate. Do coupons save money? Yes. Can you get really good deals if you use them? Yes. Are coupons available virtually every place you look? Yes. Are they the only way you can be a good steward of your money? No. I do not support the contention that if you do not use coupons, you are a fool who likes to throw away good money. I do, however, support the contention that if you use coupons on items that you use regularly and couple that with looking for good deals, you can save even more money. I also support the contention that coupons are not the only way to save, and to insist that they are is just bad advice.

And please don’t even get me started on saving money on raising kids written by people who don’t have them. That might be a cranky post unto itself.

If you notice a theme in my rant, it’s the fact that many bloggers refuse to accept a middle ground. Many bloggers believe that what they are spouting and preaching is the end all and be all of personal finance information. But let me make my opinion clear: No one way is right. No one way is wrong. It’s what makes personal finance personal. Each person needs to find a method or information, and then adapt that to her own life. To suggest that doing it any other way than what one particular person does our readers a disservice.

In my limited experience as a blogger, people read personal finance blogs for a variety of reasons: to learn, to be entertained (as entertaining as money can be), to commiserate, to feel less lonely in their pursuit of a more frugal lifestyle or debt repayment journey, to connect with someone who’s in the same situation, or to just pass the time during their lunch break. But whatever their reason, we have a responsibility to not insult the reader or condescend to the reader. We have a responsibility to provide information and options, and to share our stories.

Implying that only one way is correct doesn’t help. We need to accept our role as information sharers rather than information dictators.

That’s how we connect and affect change.

I think it’s all very geographical, too. Like, sure the car thing might work in a huge city where there is an abundance of alternatives to driving, but then a)it’s more expensive to live, and b) it forgets about all of the people who live in areas where public transportation is dismal, or who live an hour drive away from work and a 2 hour bus ride.

Also, coupons aren’t that prominent in Canada. We do forget that some people live different lives than us, and what WE do doesn’t translate into the “right” way to do it.

Daisy @ Add Vodka recently posted…Free Time After Graduation Revisited

I liked what you said about people writing posts about saving $$ while raising kids and they do not have any, and how that is tiresome. I think you should write a post about that.

Mackenzie recently posted…Taxes, Fees, and Oh Yeah…Cable

*applauds*

Bridget recently posted…What you can learn about blogging from 50 Shades of Grey

Awesome article Jana. as writers/bloggers we are fact AND opinion based. There are a bunch of right answers. Like Daisy stated before a lot comes from geographical location. But you hit the nail on the head here.

Sean @ One Smart Dollar recently posted…Student Loans for Graduate Students

I don’t recall reading posts like the ones you describe – but that may be because I tend to not read blogs that are very dogmatic about things that are irrelevant to my life.

I appreciate your point that strategies that work for one family won’t translate fully to another family. But I disagree that finances is ALL about grays – I like to make things as black and white as possible for my personal finances. There’s still a lot of gray, but I’ve found that my personality works well with strict rules within which I know I can be successful. I don’t think I write in a way that forces our rules on anyone else, though – if you notice it on my blog, please let me know so I can reevaluate!

Emily @ evolvingPF recently posted…Blog Statistics Update June – July 2012

I so agree with you. I read PF blogs for entertainment but also to keep me sane so that I’m not constantly thinking about my problems. I love hearing people’s problems and how THEY solve them. Not telling me how I should solve mine. I write to share my experiences and to hopefully do the same for others. Loved this post J!

From Shopping to Saving recently posted…Dealing with Financial Stress and Grad Student Loans

This is such a great post. You make my heart smile!

“And please don’t even get me started on saving money on raising kids written by people who don’t have them. That might be a cranky post unto itself.” I would LOVE to read a cranky post about this!

Jenniemarie @ Another Housewife recently posted…Happy Happy Birthday Kailey

Love, love, LOVE this! We are all different. We live in different regions, or countries, with different income levels and different issues. I wish I could give up cable, but Netflix in Canada is a joke, and Hulu isn’t available. So…. I pay for cable. Such is MY personal choice. 🙂

I try to tell stories, share what’s working, and what’s not. Those are the blogs I like to read best – I’d rather not read another list of the best mutual funds to invest in for my retirement!

Kris @ BalancingMoneyandLife recently posted…Weekly Link Love – July 20, 2012

Love this post! I always try to say what I do for my problems but that’s because it worked for me. Key word is me. I read pf blogs so I can stay motivated that it is not just me in debt and to gain perspective on how others thought outside the box. Not necessarily all of their ideas are going to work for me though. I love when people say to not own any car–I live in a “small” town but it’s big enough that I need a car because there is no public transportation. Well there is but it is lacking. And I try to stay away from topics that I don’t know about.

bogofdebt recently posted…July 20th Friday Link Lovin’

I loved reading this! The main reason I blog was to share my stories and opinions with others and to entertain people. As many bloggers have stated, Personal Finance can get very dry and boring. I really enjoy reading about other people’s personal stories and even rants. They’re the ones who actual make personal finance PERSONAL.

MakintheBacon$ recently posted…Dating in the Workplace: Recipe for a Bad Romance?

I hope when people read m blog they realize I am offering one or two of many possible situations or solutions. I am a big fan of do what works for you. Debt snowballs vs avalanches vs other debt repayment plans are all options and some will work better than others for different people. Great post and so true. Hopefully no one reads my blog in terms of absolutes. I would prefer they read it in less than 50 shades of grey though.

Lance@MoneyLife&More recently posted…Random Thoughts, Round Up and Carnivals #13

You go Jana! I couldn’t agree with you more. I always try to stress the importance that we’re all different and have different situations and values that make everything unique.

Nothing will work for everybody, we all have to find what works best for us.

We’re a 1 car family and it’s okay (meaning I haven’t died just yet) since I don’t have a job. I’d love to have another car, but right now it’s just not a priority for us. Some people couldn’t do just 1 car and would do what needed to be done to make sure they didn’t have to.

There isn’t just one way to do most things financially, and we all have to find our own way.

LOVE IT, LOVE IT, LOVE IT! Awesome post, Jana. 🙂

Jen @ Master the Art of Saving recently posted…Where Did The Dough Go? #63

There are some wildly successful PF bloggers who seem to preach on a daily basis about how renting your home is the only way to go, and come pretty close to equating people who have a mortgage being maybe one step better than someone infected with the bubonic plague.

It’s annoying.

Renting for some makes perfect sense, but for others, having a mortgage is a great financial move. Besides if everybody rented, who’s supposed to own all the d*mn houses?

Money Beagle recently posted…How Barbequing Got Ten Times More Enjoyable Over The Past Two Years

I think there are some tenets we can all agree on, like consumer debt and living within your means. But I’m definitely over most of the well worn topics (see: http://eemusings.wordpress.com/2012/03/27/personal-finance-topics-im-so-over/)

eemusings recently posted…Link love (powered by red shoes and hot chips)

I agree with what you say. Finances are a gray area and not black and white. If they were we’d all be rich. I believe that people need to assess their own situation and do what is right for them.Setting SMART goals and setting out to achieve them is something anyone can do provided they are working towards a positive outcome they set forth.

If someone want to sit on the couch all day and moan they are skint, there’s no jobs, the government is corrupt and doesn’t do a damn thing about it, what can you say, right?

There really is no one hard and fast way to get people to debt freedom. You can’t copy what someone else does but you can learn from them. You can learn from their journey things you may have never known. I learn alot from many pf bloggers especially from their personal experiences.

As for coupons, well it is what it is. Like Daisy says you can’t compare Canada and US for couponing as it’s not so prominent here. If people watch that Extreme Couponing show and think they know all about couponing in Canada people are sadly misinformed. People certainly won’t get rich from using them, and it’s not the only way to save that’s for sure but there is money to be saved. Frankly I don’t care if someone wants to pay full price for a bottle of listerine and there is a 2.00 coupon in front of them. Not my bank account. It’s more about awareness rather than what you can and cannot get. I think some people are missing that point and jump to the convenience crap because they see some lady in the US dump 200 chocolate bars in a shopping cart on tv.

The kids issue well we don’t have kids and I’ve talked about kids from the perspective of once being a child. I certainly don’t talk about changing diapers and feeding times but money is money and I was once a child. I leave the rest up to the mommy pros who like to guest post for my fans.

Thanks for sharing your thoughts.

Mr.CBB

Canadianbudgetbinder recently posted…5 Reasons You Won’t Get Out of Debt