I’ve been cranky about a few things lately. I’ve decided that I’m going to share those things with you because you might be cranky about them, too. If not, please just bear with me. If you’re not in the mood for crankiness, that’s totally fine, too. I understand.

There is something that occurs with some regularity in the personal finance blogosphere that irks me to a fairly large degree. I’ve been struggling with how to phrase it properly but then I gave up on that so I’ll just sum it up this way:

It’s the “all or nothing” attitude that many bloggers convey.

It bothers me that many bloggers take the position that finance lives in absolutes. It does not. Finance is all about grays; it’s not black and white. What may work for one blogger may not work or cannot work for another. For instance, my family will never be a 1 car family. That works for us. But for many bloggers, they would assert that in order to be frugal or smart with money, a family must only have one car and having two cars is a sign of overspending, a waste of money, and the first step down a narrow, dirty hallway of financial irresponsibility. It’s as if they forget that there are different places in the world, complete with different circumstances and logistics. That’s not really helpful.

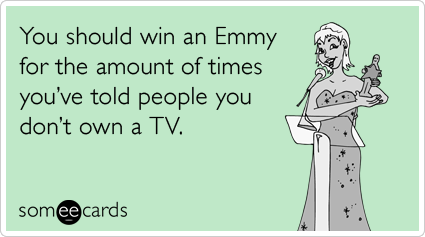

Neither is asserting to the world that you do not watch any television at all and are therefore more well read, more well rounded and more productive. Speaking from experience, it is possible to be a bookworm, a productive, engaged, inquisitive individual and still indulge in a crappy reality show or serial drama every now and then. Watching TV does not spell the demise of a person’s intelligence or productivity; it just means that that person likes to turn her brain off every now and then and just relax. And there is absolutely nothing wrong with that. TV shows in moderation do not ruin a person, but I will concede the point that too much programming might interfere with other pursuits. Depending on the person.

Neither is asserting to the world that you do not watch any television at all and are therefore more well read, more well rounded and more productive. Speaking from experience, it is possible to be a bookworm, a productive, engaged, inquisitive individual and still indulge in a crappy reality show or serial drama every now and then. Watching TV does not spell the demise of a person’s intelligence or productivity; it just means that that person likes to turn her brain off every now and then and just relax. And there is absolutely nothing wrong with that. TV shows in moderation do not ruin a person, but I will concede the point that too much programming might interfere with other pursuits. Depending on the person.

Then there’s the whole issue of coupons. I can’t stand this debate. Do coupons save money? Yes. Can you get really good deals if you use them? Yes. Are coupons available virtually every place you look? Yes. Are they the only way you can be a good steward of your money? No. I do not support the contention that if you do not use coupons, you are a fool who likes to throw away good money. I do, however, support the contention that if you use coupons on items that you use regularly and couple that with looking for good deals, you can save even more money. I also support the contention that coupons are not the only way to save, and to insist that they are is just bad advice.

And please don’t even get me started on saving money on raising kids written by people who don’t have them. That might be a cranky post unto itself.

If you notice a theme in my rant, it’s the fact that many bloggers refuse to accept a middle ground. Many bloggers believe that what they are spouting and preaching is the end all and be all of personal finance information. But let me make my opinion clear: No one way is right. No one way is wrong. It’s what makes personal finance personal. Each person needs to find a method or information, and then adapt that to her own life. To suggest that doing it any other way than what one particular person does our readers a disservice.

In my limited experience as a blogger, people read personal finance blogs for a variety of reasons: to learn, to be entertained (as entertaining as money can be), to commiserate, to feel less lonely in their pursuit of a more frugal lifestyle or debt repayment journey, to connect with someone who’s in the same situation, or to just pass the time during their lunch break. But whatever their reason, we have a responsibility to not insult the reader or condescend to the reader. We have a responsibility to provide information and options, and to share our stories.

Implying that only one way is correct doesn’t help. We need to accept our role as information sharers rather than information dictators.

That’s how we connect and affect change.