Confession: I refuse to join the PTA at my daughter’s school. Why? Because they are fundraising whores.

Confession: I refuse to join the PTA at my daughter’s school. Why? Because they are fundraising whores.

Every day, my child comes home with papers upon papers from the PTA, telling us about a fundraiser at this restaurant or asking us to solicit friends and family for their money or trying to sell some crappy product. It’s maddening. I mean, I’m all for supporting my daughter’s school and her education, but I don’t feel that my bank account (or the bank account of people I care about) need to be drained in order to demonstrate that support.

Not only am I frustrated with the amount of times they ask us for money, but there is absolutely no disclosure as to where the money is going. Are they raising it for equipment for the school? New books for the library? Updated computers in every classroom? A school supply pool so that parents no longer have to contribute to school supply welfare? All they tell us is that the PTA is raising money for the school. They don’t tell us why. And maybe if I knew why, I’d be more inclined to contribute.

There’s also this—they brainwash the kids to think that if they don’t participate in these fundraisers, they’re essentially punished. They don’t win the prize, they don’t support their school, and they’ll be left out because they didn’t do it. What the hell kind of awful lessons are these to teach to our kids?

I just can’t be part of an organization that does that. So I opt not to.

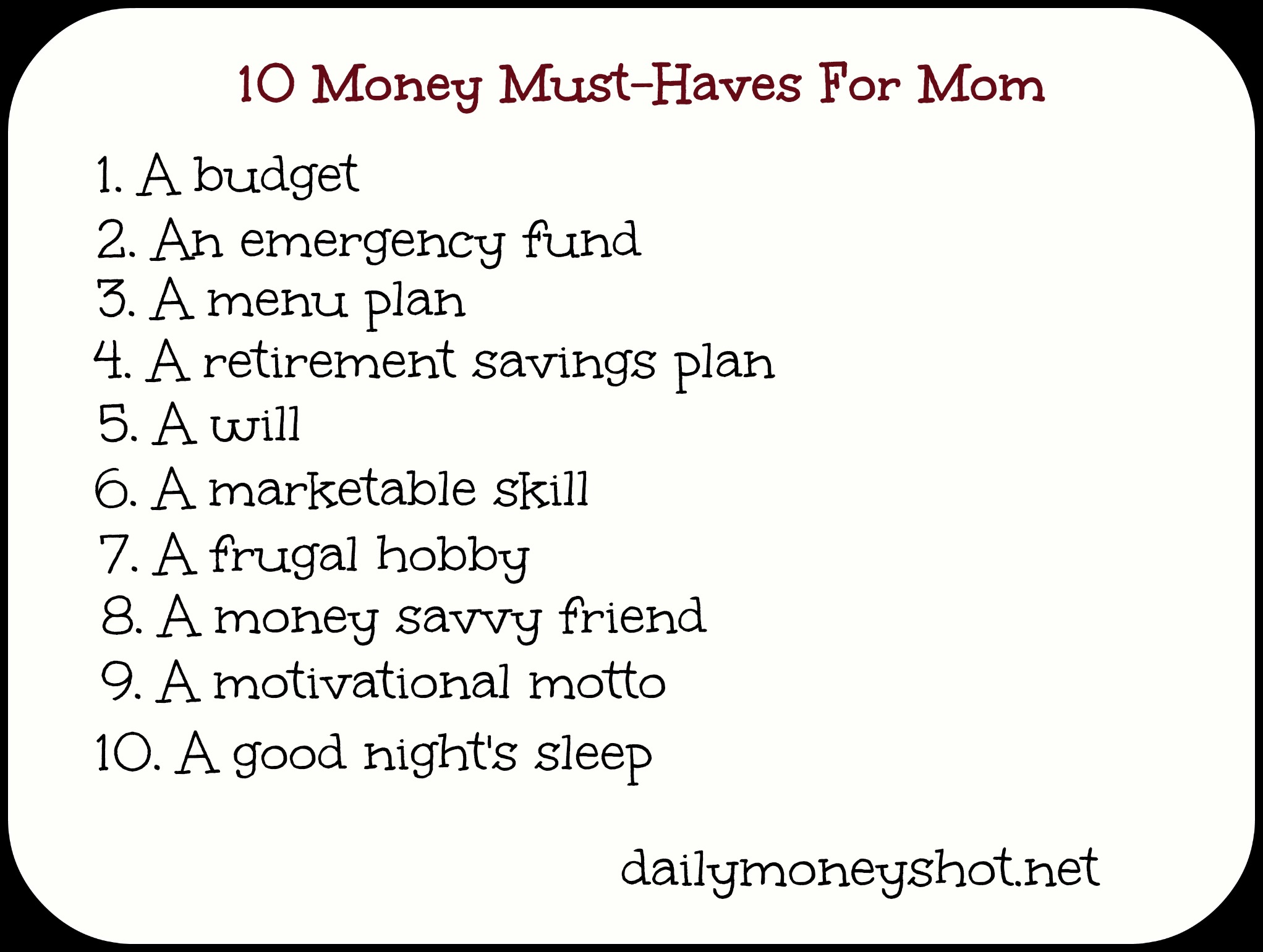

Opting out of the PTA doesn’t mean that I don’t support my child’s education. In fact, there are plenty of ways to be involved without joining the PTA or spending a fortune on PTA fundraisers. Just because I choose not to reach into the deep recesses of my wallet to support my child’s school, doesn’t mean I don’t do anything to support the school or her education. And if you, too, don’t want to join the PTA at your child’s school, you can join me in these inexpensive options:

- Volunteer. Whether it’s helping out at lunch or chaperoning a field trip, parents make a huge difference when they volunteer at their child’s school. It’s helps the teachers out (and they’re very grateful for that), and it gives you an inside look at the dynamics of the class. I’ve learned so much about my child’s day and her friends just by observing what’s on the walls of her classroom.

- Help with homework. And read the literature that gets sent home. This is especially beneficial for younger kids, like my daughter, who aren’t as independent as the older ones. Assisting with homework is important not only to reinforce the lessons that they’re learning at school but you get to see, firsthand, what they’re learning. Letters from the principal and classroom notes fliers are also great for providing this information.

- Communicate with the teacher. If your child isn’t forthcoming about information, take the time to communicate with her teacher. Send an email. Make a phone call. Attend a parent-teacher conference.

- Pick and choose which fundraisers you participate in. There’s no reason to participate in all of them. It’s expensive and tiring to do them all. Plus, you don’t want to come across as begging family and friends for their money. So, decide at the beginning of the year what your fundraising budget is (and determine how many you will participate in) and stick to it. If that means you attend a few restaurant events and sell one product, then that’s all you do. No need to feel guilty or go broke raising money for someone else, even your kid’s school.

- Make a one-time donation to the school. And leave it at that. When I ranted about this on my personal Facebook page, some of my teacher friends said that they make a donation to the school at the beginning of the year, ensuring that a) their kids get the ridiculous trinkets and b) they don’t feel guilty not participating in anything else. They’ve done what they feel is right and what they can afford and they move on.

There’s also this option, and it’s one my husband came up with. When the school sends home a fundraiser, talk to your kid about it. Explain the cost of all the fundraisers, why the school is doing is (even if it’s in vague terms), how much time it takes, and the true value of the prizes. Then find something that your kid really wants (like a Disney cruise, if you’re my kid) and compare the prices and value. Tell your kid that for every dollar you don’t spend on a fundraiser is money you can put towards saving for that goal.

I like this idea. It teaches kids about savings, it teaches a lesson about fundraising and how little, cheap prizes really aren’t all that valuable, and that asking people for money with no purpose isn’t necessarily the best way to treat your friends and family.

I don’t know what happened to the PTA. I knew that they always had their hands in raising money for the schools, but I always thought it was more than that. It makes me sad it’s no longer this way. At least, not at my daughter’s school.

Parents, how do you handle PTA fundraisers? Is your PTA similar to ours?