Today’s post is a guest post from my friend S who blogs at American Debt Project. American Debt Project is a blog about paying off debt and understanding the patterns and behaviors that get Americans into debt in the first place. She also blogs about income inequality, investing and the fascinating dynamics of living in Los Angeles and Southern California.

At the risk of sounding like a Cosmo magazine rip-off, a girl’s gotta have friends that she can talk to about anything. I consider myself lucky to have friends with whom I can discuss all manner of embarrassing, intimate and psychologically harrowing topics.

At the risk of sounding like a Cosmo magazine rip-off, a girl’s gotta have friends that she can talk to about anything. I consider myself lucky to have friends with whom I can discuss all manner of embarrassing, intimate and psychologically harrowing topics.

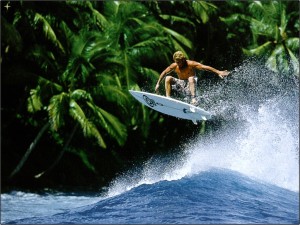

There’s been one topic burning a red hole in my mind lately: Jealousy. I found myself feeling completely jealous after seeing the website of someone who is a friend of a friend who just happens to be a professional surfer. When I saw her recent trips to Kauai, Bali and the Caribbean, I think I experienced some mild heartburn mixed with tangible anxiety as to why my life didn’t include exotic trips to warm, sunny beaches and photoshoots of me posing on said beaches. To make it worse, this girl is beautiful, much younger than me and probably makes quite a nice annual income before even graduating high school. I don’t begrudge her success because surfing is one of the toughest sports out there and she RIPS. After two years, I can still only ride the smallest of waves with my funboard. I know she’s talented and deserves success, but I was still thinking about it all day and wanting my own life to be filled with plane rides, free clothes from sponsors and lots of fun down time to hang out friends and post pictures to Instagram. I got even more worked up because it is simply too late for me to become a professional athlete at 28. “Why is this jealousy consuming me?!”

I knew exactly which of my friend/therapists I needed to discuss this with, and we were headed out to dinner that night. As soon as I got in the car with her, I asked her: “Have you…like…ever felt jealous of anyone?” She looked at me like I might have suffered a concussion earlier that day. “Uh yeah, all the time!” She mentioned that some of her friends from college had found serious success with some multi-level marketing company they had started (which is the only way to make money from a MLM) and were always posting photos on Facebook of their newfound wealth. But she had a simple solution: “I just started defriending them. I think the last picture I saw was his orange Lamborghini and after that I just deleted him. I don’t need to see that every day.”

That, my friends, is the definition of a good friend. I realized how awesome this girl is who can be so honest with me and herself and give such simple but useful advice as don’t pore over photos of people who make you jealous. It wasn’t getting me anywhere to look at photos of rainbows over the Islands of Aloha which made me want to bang my head against my cubicle wall. And what’s worse, I was mad at myself for having a normal reaction of jealousy.

I have a confession: I am a little bit holier than thou. I think that I never ever feel jealous or envious, when the truth is that for the most part, I don’t feel jealous of other people’s lives because their goals are not my goals. I don’t lust for an orange Lamborghini, that picture would have probably just made me laugh. I don’t want a high-powered corporate job because I’ve had the 70-80/hr week corporate job and I’m not sure I could handle that kind of stress long-term (at least not working for someone else). I don’t want a Louis Vuitton handbag. So I can look at people’s lives and think, “Well, good for them. I’m glad they’re happy.” But when I saw someone living out a life that seems to me like absolute perfection, I did get jealous. I want the freedom to do those things too, without going into debt for it.

It’s OK to feel jealous sometimes. You don’t have to pretend like you are completely Zen and happy for everyone and 100% satisfied with your own life. In fact, if you’re reading a personal finance blog, you are probably looking to improve your life in at least a few aspects. But just remember not to dwell on that envy for too long, or spend an hour on Facebook/Twitter/Instagram feeding your mind with images of someone else’s happiness. I may not have a perfect life, but I still wouldn’t trade for anyone else’s life, no matter how many cheetah-print bikinis and double rainbows are involved.