Yesterday I participated in a Twitter chat with one of my favorite sites, UpWorthy. The topic was parenting and raising good citizens and our concerns about both. Towards the end of the chat, I became involved in a discussion with some of the other participants about giving kids good self-esteem. She mentioned that she has an exercise that she’s done with her own sons–writing a list of 10 things they like about themselves–and has done with elementary school classrooms as well.

Then she said that when she did the exercise with a class of third graders, there were some kids who could not think of one part of themselves they liked. This was a direct result of what the adults in their lives say to them or what they hear the adults in their lives say about them.

Then she said that when she did the exercise with a class of third graders, there were some kids who could not think of one part of themselves they liked. This was a direct result of what the adults in their lives say to them or what they hear the adults in their lives say about them.

Take a minute to let that sink in. Eight and nine year old CHILDREN could not think of anything good about themselves because of the impact the adults in their lives had on them. That’s the power adults have. We have to power to make kids feel like they don’t matter, like they’re unimportant and that they have no good qualities. We have the power to destroy their self-esteem.

But we also have the power to do the opposite. We have the power to build them up and make them feel good; like they can conquer anything. We have the power to make them realize just how important they are–important to themselves, to us, to the world as a whole. And it doesn’t take a ton of time or effort. Or even money. Just doing some of the following:

- Praise them. Even if you think it’s for something mundane like homework or chores, tell them they did a good job.

- Be present. Show up for a sports game or a music concert or if your kids are younger, offer to volunteer for an hour in the classroom or chaperone a school field trip. Your presence makes a huge difference to a kid, whether he admits it or not (and even if he says he’s embarrassed).

- Ask about their day. It doesn’t matter if it’s during dinner or at 5:00 the next morning when you’re both getting ready for school or work. Take 5 minutes and ask if they’re nervous for the test or if they have plans after school or who they sat with at lunch.

- Be involved. Not helicopter, hovering parent involved. But knowing what classes your kid is taking or who their friends are or even what music they like to listen to is being involved and shows that you care. Kids like it when parents pay attention.

- Show affection. It can be a hug, a high five, a smile…pretty much anything (obviously the level and type of affection will depend on the nature of your relationship).

- Offer encouragement. Tell the child you believe in him. Support his efforts. Be there to say “keep going. I know you can do it!” And do this unconditionally, even if his choices are not what you would have necessarily made for him (unless those choices are dangerous and/or criminal and/or self-destructive).

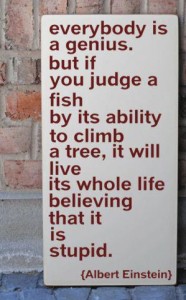

- Set them up to succeed. Play to their strengths, not their weaknesses (and for the love of all that is holy, never tell a kid “you’re not any good at that”). It’s like this quote:

- Offer nice words. Kids want to hear people say nice things to them. Positive reinforcement is good. “I’m proud of you” goes a long way. Try to say at least one kind, positive sentence a day. And don’t always make it about their appearance. They need to understand that their self-worth is not always related to how they look.

- Include them in conversations about them. This is particularly important for older kids. If you’re at a meeting with a teacher, coach, school counselor, probation officer, or anyone else, and the kid is present, include them in the conversation. Ask her questions and ask for her input. Don’t talk about her like she’s not there. She is and she can hear everything you say. So choose your words carefully.

Now, we need to note that as parents, aunts, uncles, teachers, whatevers, we can do all of this and a kid can still turn out with low self-esteem. Peers can play a huge part in that, and, in that case, all we can do is provide a safe place for them to turn and for us to tell them what their classmates say isn’t not true. Unfortunately, we can’t make the kid believe us over their peers. But we sure as hell can try. And we sure as hell need to.