Last week, in my birthday post, I mentioned that I took a government job over a job at a consulting firm upon my completion of graduate school. I had asked if anyone was interested in hearing why and, surprisingly, people were! Since I appreciate feedback and content suggestions, I bring you the story of why I choose a government job.

Last week, in my birthday post, I mentioned that I took a government job over a job at a consulting firm upon my completion of graduate school. I had asked if anyone was interested in hearing why and, surprisingly, people were! Since I appreciate feedback and content suggestions, I bring you the story of why I choose a government job.

I finished graduate school in 2001 with a degree in Urban Affairs and Public Policy, concentrating in nonprofit organizations and a specialization in program evaluation. This, my undergraduate degrees (yes, I have 2. I double majored as my majors were closely related), and my internship and work experience put me in a pretty decent position for employment (which one would hope for after 6 years of college). Encouraged by my advisor and the fact that I needed to do something after graduation (and I had no interest in a PhD), I applied to a number of jobs. And, by some stroke of luck, I wound up with 2 offers.

To this day, I’m still not sure how it happened. Or how it happened twice (once when I completed grad school and the second time, a year later, when I was looking for a job after I got fired from my post-graduate job).

Picking between two jobs is never an easy task. It’s not made any easier when the jobs you’re offered are equal in a number of important ways (salary, benefits) but completely different in other ones (location, job function, permanency). That’s the situation I faced both times I had to choose between two offers.

The second time, the decision was a bit easier. I had to choose between a possible temp to hire job doing institutional research at a suburban community college (I know! I used to be smart!) and a reintegration social worker in a major city. While the research job was more in line with my education and employment history, I wasn’t willing to take the risk of not being hired at the end of my contract (the whole “it’s your job to lose” speech is not exactly inspiring). So, I took the other job.

In my book, permanent will almost always trump temporary.

The first situation, though? That decision was rough. I had to choose between a consulting job in Washington DC (one of my favorite places) and a federal government job in Philly. Both had the same starting salary, benefits, and I needed to move. But there were some key differences that warranted much discussion both out loud and in my head. This is pretty much how my thought process went:

Cost of living. Neither Philly nor Washington DC is an inexpensive place to live. But when I started comparing the two, the Philly suburbs were, without a doubt, less expensive than DC suburbs (I have an aversion to living in a city). When I looked at how far my $30K salary (not a bad starting salary in 2001) would go for all my expenses, Philly won. By a landslide.

Scope of work With the consulting job, my duties would vary from project to project, as would my clients, and there was no guarantee that I’d do what I had just spent 2 years in grad school learning to do. With the government job, I had consistent clients and I’d get to use all the skills I’d just learned in school. My 24 year old mind couldn’t see the potential in the consulting job, so the government job made more sense.

Stability While both jobs offered a great deal of stability and security, there’s clearly more of that with a government job. Upon graduation, I needed the immediate assurance of stability without understanding that a consulting job could be not only be more secure in the long run but would open up so many doors, even in government positions. So again, point for the Philly job.

Promotion potential Again, as a 24 year old with little guidance, I could only see the move through the pay grades as an opportunity for promotion; I didn’t think about all that could happen in a consulting firm. And when I did the research, it seemed fairly easy to move up the ranks in pay without having to assume any more responsibility (like supervising people). So that was awesome. Which again made the government job more appealing.

Work hours I don’t mind working. I really don’t. But when I thought about how I’d have to work twice as hard for the same pay at the consulting firm, the government job really made more sense. Working less meant more time for fun and friends!

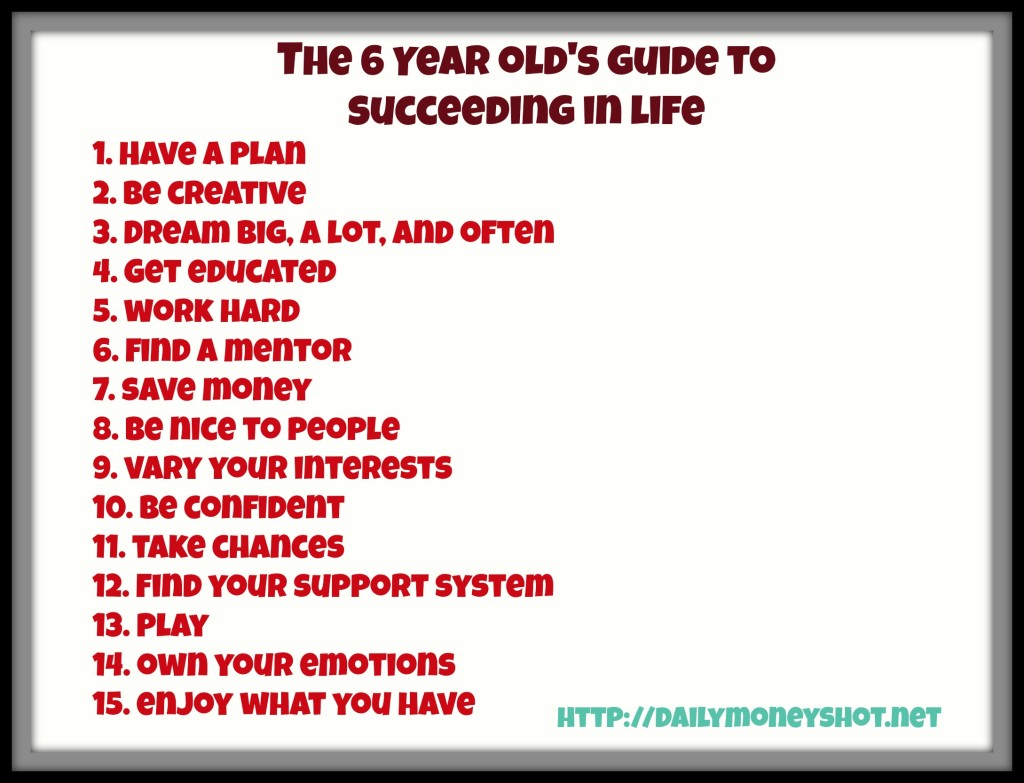

As a more experienced, mature adult, I can look back at what I was thinking and realize how messed up it was. If I could go back and talk to myself (anyone have a Delorean?), I’d tell myself to ignore the immediate and look at the long term benefits of the one job over the other. I’d ask myself which job has more potential? I’d command myself to take a chance and go live where I’ve always wanted to live.

In other words, I’d tell myself to do a lot more thinking before I made my decision.

But…

While I look back and regret my decision making process, it’s hard to regret the ultimate decision. Because without those bad choices, I wouldn’t be in the position I am today, finally realizing what I think I’m meant to do.