This is the fourth post in the Investing Basics series, written by Jennifer from To My Girlfriends. I’m thrilled to have her guest posting here, particularly on this subject. It’s been quite informative!

Before I opened my first IRA (individual retirement account), the CFP (certified financial planner) who worked at my local bank gave me a few items to peruse. I was given Morningstar reports on a couple of different funds. I needed to decide if I wanted to invest in a mutual fund that was considered a “value fund” or a “growth fund.” I took these papers home with me and made an “educated” decision based on what was given to me. There was no internet at the time to do any googling so I had to rely solely on this man’s advice, expertise, and these papers.

Before I opened my first IRA (individual retirement account), the CFP (certified financial planner) who worked at my local bank gave me a few items to peruse. I was given Morningstar reports on a couple of different funds. I needed to decide if I wanted to invest in a mutual fund that was considered a “value fund” or a “growth fund.” I took these papers home with me and made an “educated” decision based on what was given to me. There was no internet at the time to do any googling so I had to rely solely on this man’s advice, expertise, and these papers.

The Morningstar report I was given had information on what the top 10 stocks of the fund were, how many stars this Morningstar agency gave the fund (5 being the best), and a list of past returns. I honestly don’t remember what fund my original IRA was invested in other than it was in the Putnam family of funds. I looked at the list of companies that the fund was invested in at the time and made my choice based on my opinion of where I thought the most value was. Have you ever done this? In my experience I have found that what I did to choose my investment is not unheard of. One of the other very common dilemmas is that people are so overwhelmed with their choices that they do nothing for fear of making a wrong decision.

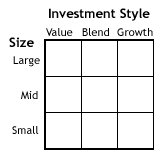

Now I know that what I originally based my decision on is called investment style. A lot of time you will see this box on an analyst’s report:

The Size on the left hand side refers to the size or the company in market capitalization. So let’s discuss what a Large Cap, Mid-Cap, or Small Cap fund is and then we will cover Value, Blend, and Growth.

- A Large Cap company is a company that has over $10 billion in market capitalization. For example, Wal-Mart, GE, McDonald’s would all fall in this category.

- A Mid-Cap company is a company that has $2-$10 billion in market capitalization.

- And then there are the Small-Cap companies that have between $300 million – $2 billion in market capitalization.

Keep in mind that most large and mid-cap companies started out as small cap companies. The dollar amounts I inserted are industry standards overall. The valuations of a company change over time. Small cap companies are considered riskier than more established large cap companies, but the advantage of investing in one is the possibility of being on the bottom floor of an up and coming company. The disadvantage is that they aren’t very well-established and could disappear tomorrow.

- A Value Fund will invest mainly in companies whose stock is “undervalued” to the industry. The company has fallen out of favor usually because of poor earnings. A lot of value stocks pay dividends.

- A Growth Fund will invest mainly in companies whose earnings are supposed to grow faster than their industry standard.

- A Blend Fund is a mix of both value stocks and growth stocks.

The biggest challenges for most people is figuring out their style. By this I mean what level of risk can you tolerate. And this will change over time. I have found, through experience, that the less money a person has in investments the more risk they are willing to take on to grow that investment. As the investment grows, the investor will become more cautious to protect their dollars. Of course this is a generalization and totally based on my personal experience with clients and myself.

Jennifer,

Have you changed how you invest your money since you first started doing so? Do you find you’re willing to take more risks or invest more cautiously?

Thanks!

-Christian L. @ Smart Military Money

Christian,

I have totally changed how I invest since I first started. I don’t use an advisor any longer. I don’t invest in mutual funds any longer either. I invest on my own. I read charts daily. It has taken me a long time to get here, but it is my passion. I don’t advise the faint of heart to do what I do without education, which I have spent thousands of dollars on, and lots of practice with papermoney.

Jennifer @ tomygirlfriends.com recently posted…Saving money on utilities

Jennifer,

I disagree with your comment that when people have little to invest they should invest in aggressively and only when it has grown should they become more conservative. When you first learned how to drive did you immediately jump into the fast lane or did you drive on surface streets first then slow lane of the freeway then eventually the fast lane. This way you had experience with the car and better control. Just my opinion.