…and dads and grandparents and pretty much everyone else.

This idea came to me after seeing a picture on Facebook posted by Jen from People I Want To Punch In the Throat. While I love the original list (which you can find here) for its snark and sarcasm, I thought it might be a good idea to strip that away for a moment and think practically about the financial things we need. After all, without our finances in tact, how are we going to pay for the babysitter, wine, trips to Target, and girls’ night out?

We’re not.

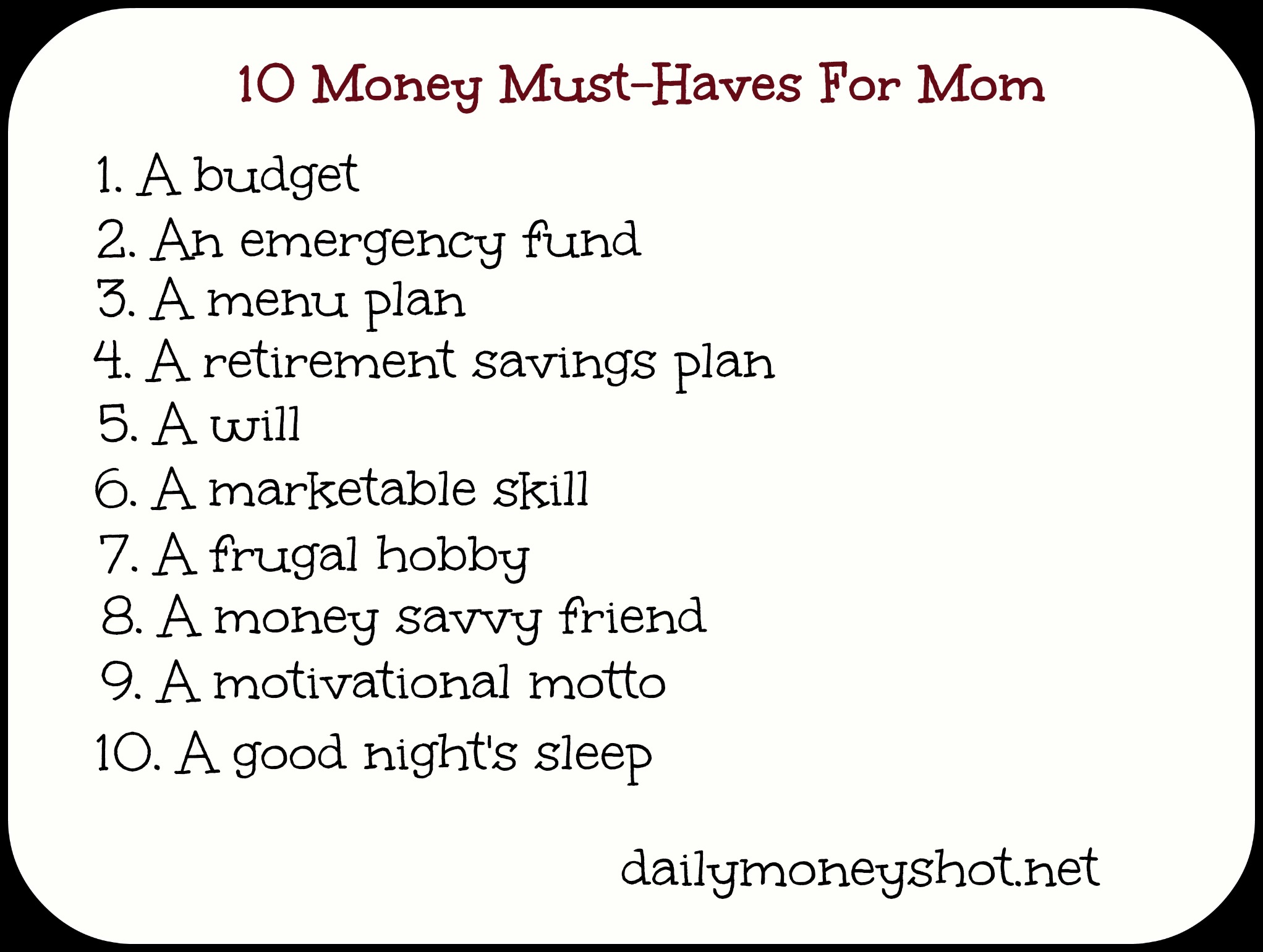

So, here we go. My 10 money must haves:

- A budget–you need to know where your money is going and how much you have coming in. Without this, you’re kind of screwed.

- An emergency fund-because shit happens and you need to be prepared. If the 3-6 months is too intimidating, start small. But just start.

- A menu plan–the single best way to save money at the grocery store.

- A retirement savings plan–unless you want to work forever, you need to save for the day you stop working.

- A will–because you will die. Best to be prepared and get everything straight ahead of time.

- A marketable skill–we all have one. And we all can do something that, in the event of an economic pinch, can bring in some extra income.

- A frugal hobby–shopping is fun, but why not pick up a book from the library? It’s just as time consuming but saves a ton of money in the long run. Maybe filter the savings to your EF or retirement savings.

- A money savvy friend–we all need someone we can go to with our money questions and concerns. Find one of those people and put her in your friend arsenal with the fun friend and the creative friend.

- A motivational motto–I like having some saying that get me through tough days. I even have an entire Pinterest board devoted to them. Print one and put it somewhere conspicuous for the days you doubt yourself.

- A good night’s sleep–because nothing enables bad decisions, especially financial ones, more than being tired.

Put these 10 into place and you’re ahead of everyone who says they can’t control their finances. Because when you look at it like this, it’s really not that hard.

And in case you want it in pretty graphic form:

Spot on again!

I need number nine like the desert needs the rain. My quotes get me through when other things don’t!

SMD @ Life According to Steph recently posted…Talking about ice, books, shitting on The Vine, and other crap on Haphazard Wednesday

I remember you having a notebook that you filled with good quotes. Do you still have it? I’d love to see what’s in it.

A will…the word makes me break out into hives. The whole dying thing gives me a panic attack, seriously. But, I need to get on that.

Mackenzie recently posted…Healthy Stuff…

We need to hold hands, put on our big girl panties, and get it done.

I have saved to much money alone by making a menu plan. It just helps with knowing what I need at the store that way I don’t have to make as many trips to the grocery store. The less you go the less you spend.

Tanya recently posted…The Best WordPress Anti-Spam Plugins for 2012-2013

We need to do a will. I want to do a trust which I think is better but they’re expensive to set up, so I keep putting it off! Need to quit doing that. My motivational motto is one I got from a teacher/coach in college: “It’s a great day to be alive!” He said it all the time and it stuck because you could tell he truly believed it.

Money Beagle recently posted…10 Small Things To Do Around Your House Today

It reminds me of how Dave Ramsey always says “Better than I deserve.” He really makes you believe it, which is essential to motivation. You have to believe it.

Thanks for that! I think I should print it out because I don’t have most of them 🙁 Does this post count as a number nine? 😉

Shovellicious recently posted…Where is Poland?

Yes 🙂

I just recently started an endeavor to get my finances in order. This week, I enrolled in online banking, set up a budget, made a menu plan,and I’m working on an emergency fund. It’s reassuring to know I am headed in the right direction! Thanks!

Jules@Faithful With a Few recently posted…What I Learned About Contentment From Watching House Hunters

Good job and congratulations! Sometimes getting started is the hardest part but you did it and your definitely headed in the right direction.

I’d say that people need common sense more than anything at the top of the list 🙂

Think about it…lots of people could get by without an actual budget if they had common sense. It’s like “oh let’s get a Mercedes C-Class on our minimum wage salaries” In comes common sense to smack them upside the head. “That’s right, we can’t afford one. Good thing we had common sense enough to realize that before we drove ourselves into the poor house!” (pun very much intended)

Eric J. Nisall – DollarVersity recently posted…Credit Card Surcharges Likely Won’t Affect You

You raise a good point as always, Eric. But this list was more about concrete things, tangible things, that people need. Common sense, while important and crucial to finances, isn’t something that’s easily attainable for some people.

I love this list! I need to get on these things…we’re slowing starting to chip away at the ER fund again after depleting it and need to get a will especially since we have a kiddo now!

Catherine recently posted…Saving To Rebuild Our Emergency Fund

Getting a will is something I’ve been putting off because like Mackenzie said, it makes my skin crawl. But it needs to be done. And those first few months with a newborn are killer but I do promise you that your EF will get back to where it was.

Good points! I would add a living will and Long Term Care insurance.

krantcents recently posted…I Am a PF Coach and I Should Be Fired!

Looks like I’m not alone, but I definitely need to work on getting a will in place, especially since we recently purchased a home (prior to that I didn’t really have a reason to have a will). Good list, for everyone.

Love this list! I especially like the one about having a money savvy friend – having a wise and frugal friend is so important here! I also love the one about saving..something. I just read a good post over at The Debt Myth that talks about saving 1% of your take home pay. That’s an amount I think most people can live with. Thanks for the great post, Jana!

Laurie recently posted…Why Good Personal Finance Management and Prepping Go Hand in Hand

I agree with Jackie. Any savings is better than no savings at all. 1% is still something and doesn’t sound overwhelming.